My car insurance blog 8413

The Buzz on Car Insurance - Chubb

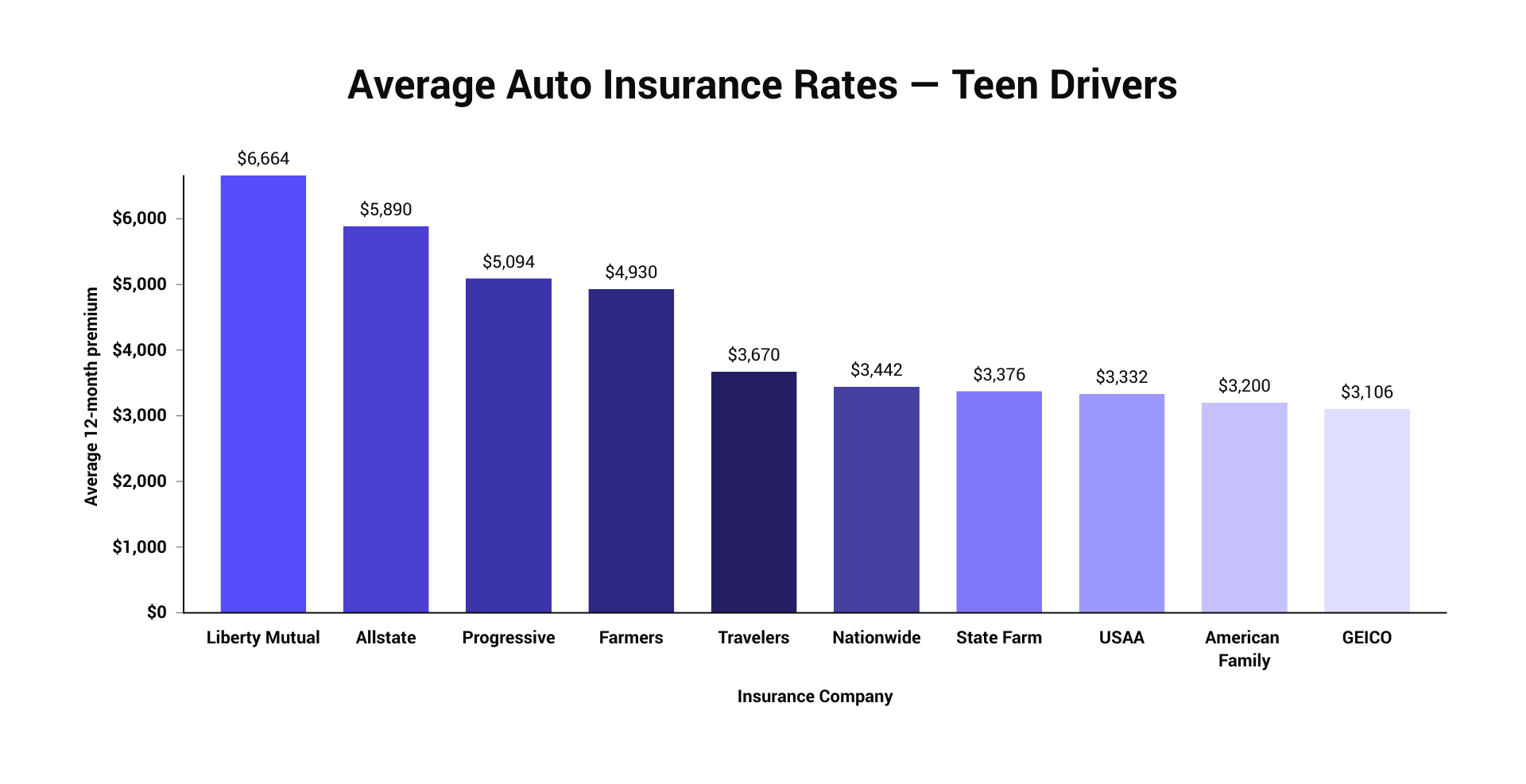

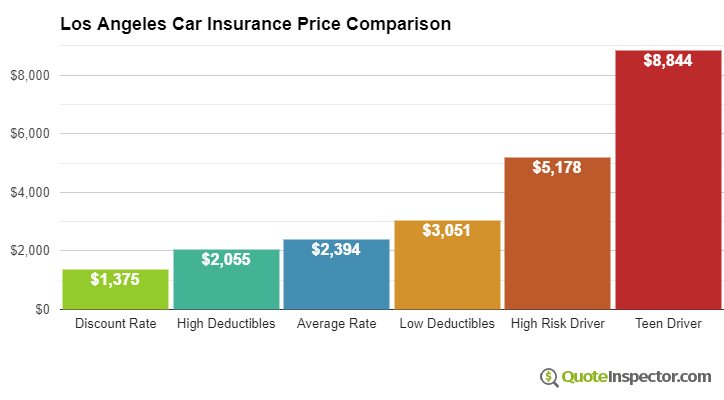

Newbie chauffeurs tend to pay greater cars and truck insurance rates, no matter age, due to the fact that insurance coverage companies element driving experience into your quote. insurance affordable. In many cases, you can expect to pay $5,000 or more for automobile insurance in your very first year of driving. You can minimize newbie car insurance coverage by shopping for quotes, choosing the best quantity of protection and searching for discount rates.

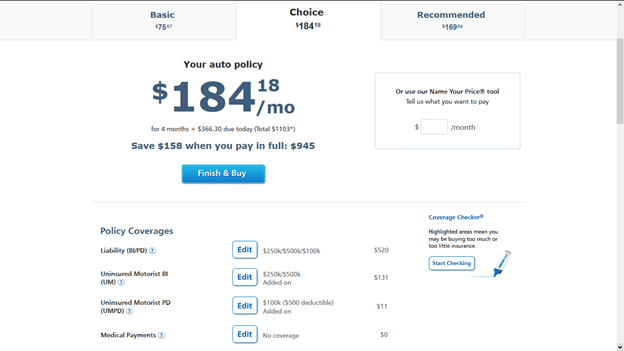

Choose how much protection you need. Get or deal with an insurance coverage agent. Compare quotes to make sure you're getting the very best deal. Once you have actually narrowed down your finest rate, you can from a lot of insurers or work with an insurance coverage representative. We advise obtaining from numerous companies to find your best rate.

Driving experience is the most essential aspect when it concerns setting cars and truck insurance rates. Experienced chauffeurs will pay far less than new motorists because insurer consider them lower dangers for getting into a mishap or suing (low cost auto). Just how much more brand-new chauffeurs will pay for cars and truck insurance coverage Typically, novice drivers pay about $4,529 each year for car insurance, whereas experienced chauffeurs are only paying $1,427 each year.

These vehicle insurance coverage rates are for a 35-year-old California local and show the distinction in cost in between a brand-new motorist and a skilled driver. The insurance prices quote for new drivers are considerably higher. Geico is the most pricey, charging our sample driver with no experience $6,339 per year.

Essentially, unskilled and first-time motorists will be charged more, no matter age - liability. How newbie motorists can discover low-cost car insurance coverage Drivers can find inexpensive cars and truck insurance if they: Search and compare insurance coverage rates. Get the correct amount of protection. Enhance elements that may affect insurance rates, such as credit ratings.

It's simple to compare. Nevertheless, speaking to an independent insurance coverage representative may offer you with numerous quotes to find the for novice vehicle purchasers. While newbie chauffeurs might have greater automobile insurance quotes than more skilled chauffeurs, you may still conserve by comparing insurers. Different companies use various elements when determining your rates, and some of the more popular insurance provider may not necessarily offer the lowest possible rate.

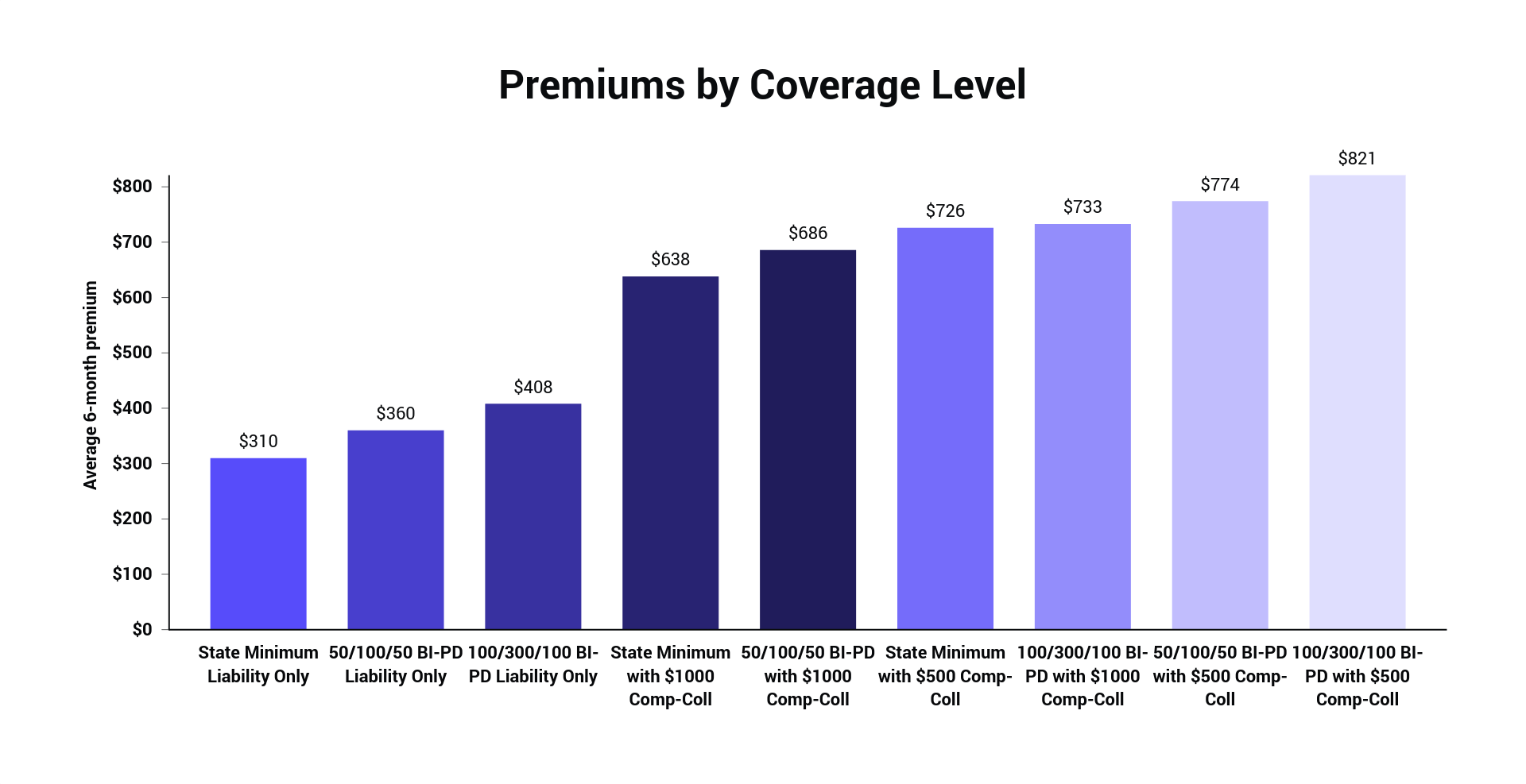

That means one way to conserve cash on cars and truck insurance is to only buy as much as is required for your scenario. Nevertheless, vehicle insurance coverage has numerous various kinds of coverage; below, we have actually offered a quick cheat sheet to direct you on how much of each type of insurance to purchase - credit score.

It is very important to understand the different types of coverage, requirements and. Otherwise, you're paying out of pocket for unnecessary expenses. Enhance factors that affect insurance coverage rates for newbie drivers Lots of elements affect automobile insurance rates for first-time drivers. A few of them can't be controlled, such as age and location.

Indicators on Insurance - Motor Vehicle Division Nm - Mvd New Mexico You Need To Know

Car insurance rates and are projected to, likely affected by increasing inflation rates over the previous year. Driving & death trends, Sources: National Safety Council & the Institute for Traffic Security Management and Research Study, In the spring of 2021, Americans drove 32% more miles than throughout the exact same duration in the previous year (cheaper cars).

Consumers shopping for coverage require to make sure the quotes they're getting are precise as it does little good to buy auto insurance coverage based on rates that doesn't totally reflect the truth of what an insurer will charge. affordable auto insurance. To ensure the quotes got when getting protection are as accurate as possible, it's a good concept to follow these 6 pointers.

Include your car's VIN number, Insurers take lots of information about each vehicle into account when setting the rate of car insurance coverage - insurance affordable. When getting quotes online, vehicle drivers are typically asked particular info about their vehicle and its security features to make sure the quote is accurate. Typically, this is info individuals don't truly know.

If a VIN is gone into when acquiring quotes, the insurance provider can gather all the information required to supply the most precise possible pricing. 2 (cheaper cars). Supply details about all of the drivers on your policy, Insurance companies also take into consideration the driving record of all vehicle drivers who will be utilizing the automobile.

They may default to different amounts of liability insurance security. Or some insurance providers may offer brand-new automobile replacement coverage for vehicles that are 2 model years old while others provide this protection for up to 3 years after purchasing a brand-new cars and truck.

If one insurer provides more comprehensive coverage as part of its basic quote, it may appear more costly at first but might really be a better deal. It's essential to know this in order to make educated choices about which policy to buy. 4. cars. Look into all the discount rates you're qualified for, Discount rates can significantly reduce the cost of car insurance so it is necessary to take them into account when buying coverage.

Considering that customers will desire to understand their last price after discounts are put in location, it's essential to research all the cost savings each insurance company uses when getting quotes. Read the great print, Some insurance companies enforce more constraints on protection than others.

6. Get at least several quotes, Lastly, it's a good idea to get numerous quotes from different insurance providers to ensure the coverages picked are suitable and to precisely compare prices. By following these 6 ideas, drivers can get precise quotes that will reflect what they'll pay for protection-- and can put in location the securities they need at the most budget friendly price.

Getting The 15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia To Work

While there are numerous factors that drive individuals to aim to alter automobile insurance providers, it is crucial to inform yourself in order to ensure you choose the best protection for you (vehicle insurance). The ideal protection means not spending for coverage you do not require and not foregoing protection that would make sense for your individual circumstance.

Did you understand Maryland is a mandatory lorry insurance coverage state? What does this mean for you? MDOT MVA now validates your car insurance at registration renewal. You can with MDOT MVA anytime on our e, Solutions Portal. In order to register your automobile in Maryland you must have liability insurance coverage (risks).

3. If you have vacated state and did not return your license plates, it is necessary for you to notify the MVA and provide the following info: Copy of registration from the state in which the vehicle is currently titled Date the vehicle was titled in the current state Maryland tag and title number If you have not yet entitled your automobile out of state, you need to have yourvehicle insurance provider provide us with policy info detailing the reliable and termination dates.

Failure to react to MVA insurance coverage notifications will lead to your case being moved to the Central Collections Unit (CCU) (insurance). As soon as your case is sent to CCU, fines go through a 17% collection charge and your earnings tax return will be obstructed. Here are the realities about lorry insurance coverage in the State of Maryland.

To get more info on how to insure your vehicle, click here to go to MAIF's website (prices). Did you receive an infraction for not having insurance coverage? What should I do if I was included in a mishap with an uninsured driver?.

Insurance isn't the most interesting facet of vehicle ownership, however it is one of the most essential. Not only is your policy designed to safeguard you from financial catastrophe in case of an accident or associated injury, it is required by most states if you own a car. Customer Reports suggests going shopping around for the best policy, not just when you buy a cars and truck, but periodically, to make sure you're constantly getting the finest offer possible. credit score.

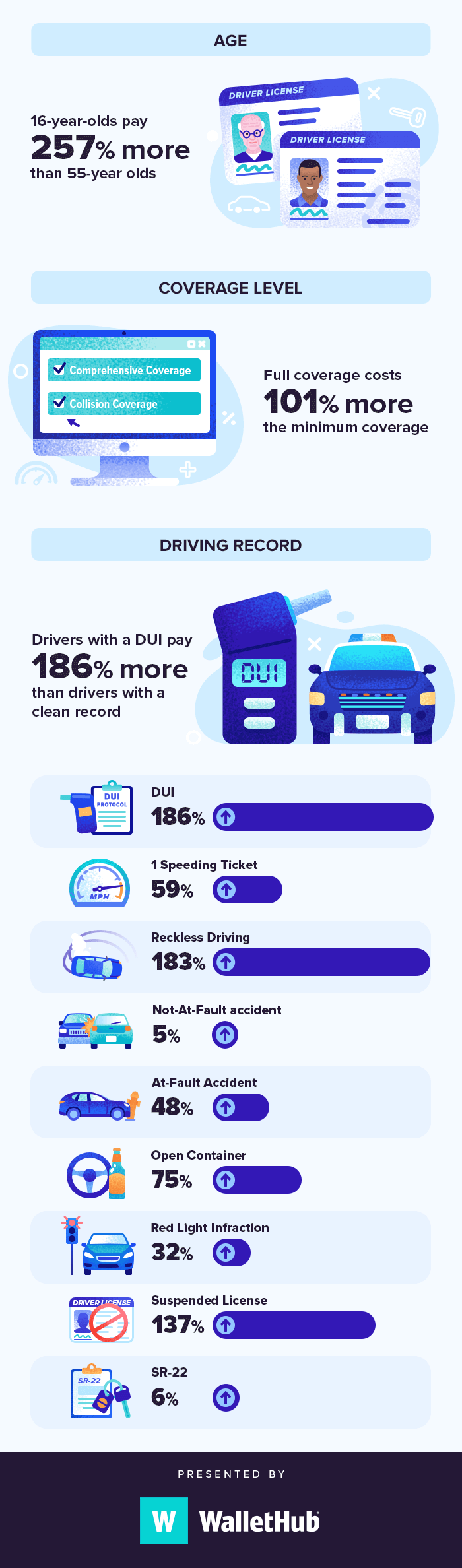

There are a number of factors to consider as you shop for an auto policy. For starters, it assists to comprehend what attributes insurers consider when they create your regular monthly premiums, consisting of the following aspects: Driver profile: Age, driving experience, and driver history all influence the cost of your premium.

Non-owned vehicle insurance can cover your liability when one of your workers sometimes uses his or her personally-owned automobile for your company. Are you looking for Non-Owner Insurance?

How To Get The Most Accurate Car Insurance Quotes Online Fundamentals Explained

You can normally carry Non-Owned coverage in addition to Employed Auto protection. Any Car coverage already includes Non-Owned coverage, so these two protections can't be acquired together. Call us directly or speak to your agent if you have any questions about your individual requirements. More details.

Any car with a current Florida registration must: be insured with PIP and PDL insurance at the time of automobile registration. have a Cars signed up as taxis should carry physical injury liability (BIL) protection of $125,000 per individual, $250,000 per incident and $50,000 for (PDL) coverage. have constant protection even if the car is not being driven or is unusable.

You need to obtain the registration certificate and license plate within 10 days after beginning work or enrollment. You must also have a Florida certificate of title for your vehicle unless an out-of-state lien holder/lessor holds the title and will not launch it to Florida. Moving Out of State Do not cancel your Florida insurance coverage up until you have actually registered your vehicle(s) in the other state or have actually surrendered all valid plates/registrations to a Florida.

Penalties You must keep required insurance protection throughout the registration duration or your driving benefit and license plate may be suspended for up to three years. There are no provisions for a short-term or challenge motorist license for insurance-related suspensions. Failure to preserve required insurance protection in Florida might result in the suspension of your driver license/registration and a requirement to pay a reinstatement fee of approximately $500 - money.

happens when an at-fault party is taken legal action against in a civil court for damages triggered in an automobile crash and has not satisfied residential or commercial property damage and/or physical injury requirements. (PIP) covers you despite whether you are at-fault in a crash, approximately the limitations of your policy. (PDL) spends for the damage to other individuals's home. insurance.

Accurate details is a must! Any inaccuracies might lead to your policy being ended. 6. Complete payment for your vehicle insurance coverage policy. When your details is sent, the final step is to spend for your policy. You're all covered and ready to go. Secret Takeaway Once you have actually chosen your car, provide your insurance coverage broker with the vehicle's specifications and let them take care of the rest.

Practically all states have requirements as to the minimum amount of cars and truck insurance coverage you require. And if you get into an accident without cars and truck insurance coverage, the legal charges will be more severeeven if you just purchased your vehicle ten minutes back (auto insurance).

https://www.youtube.com/embed/SqY85d0A5JA

Secret Takeaway Yes, you require insurance coverage prior to you can drive your brand-new car. perks. Call an insurance coverage provider or utilize a contrast and brokerage app.

Some Known Factual Statements About The Cheapest Car Insurance In The Us For Young Drivers

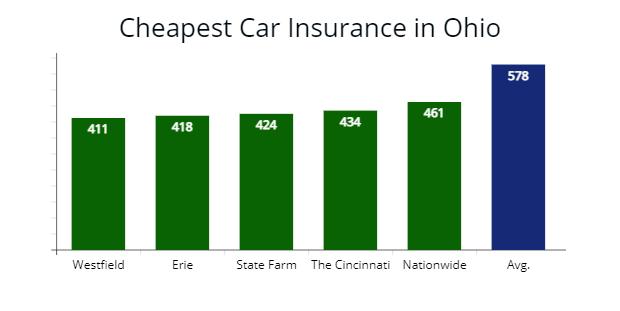

5 most inexpensive cars and truck insurance provider Below are our leading suggestions for inexpensive vehicle insurance based on average rate estimates (cheap). The following providers stand out from the competitors as the best cheap vehicle insurance coverage suppliers not only for the discount rates they provide however also for their client service and strong industry credibilities.

In specific, we have actually found State Farm to be one of the most economical choices for students. The company offers the largest trainee discount in the market (as much as 25%). Young chauffeurs can also benefit from State Farm's Steer Clear program to enhance their driving skills and get additional discount rates.

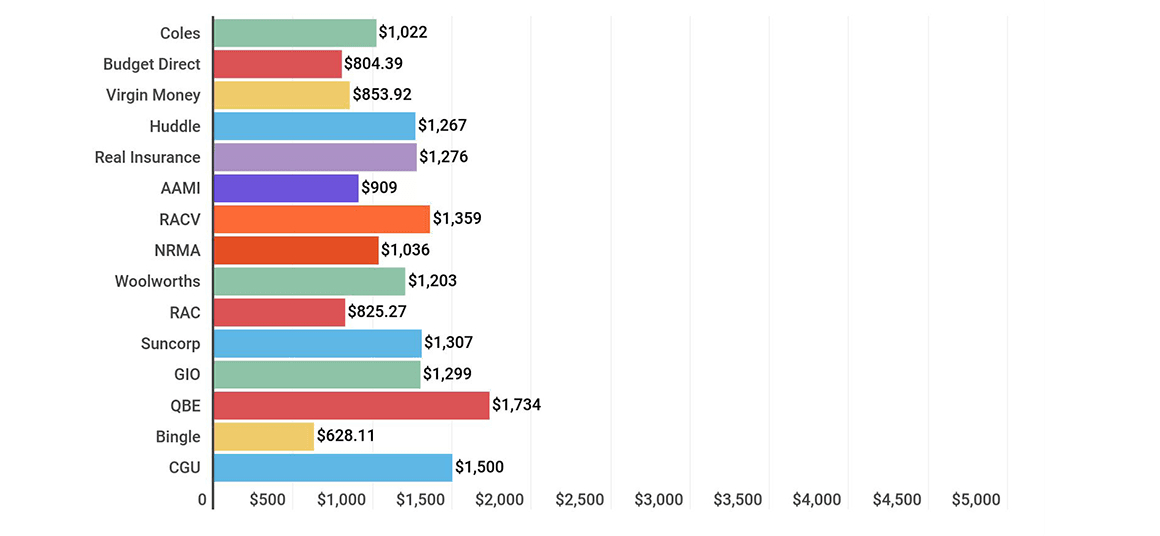

Some states have cheaper car insurance coverage than others. Below are the top five most expensive states for complete protection car insurance.

How to find the most inexpensive cars and truck insurance Car insurance coverage quotes are based upon your circumstance, your desired coverage level and the discounts a business supplies. Some things are set in stone you can't remove an at-fault mishap from your recent history, for example. That stated, there are a couple of ways you can enhance your opportunities of discovering low-cost automobile insurance coverage (cheaper auto insurance).

Companies use numerous insurance coverage products, such as renters and property owners, so you can likewise save by bundling policies. Enhance your motorist profile You can raise your credit score to get more affordable insurance coverage in numerous states.

It might take some research study, but in the end, you can likely conserve money on your next vehicle insurance plan (cars). Our approach Since consumers depend on us to offer unbiased and precise details, we produced a detailed score system to formulate our rankings of the finest vehicle insurer. We gathered information on dozens of car insurance service providers to grade the business on a large range of ranking elements.

Here are the factors our rankings consider: Cost (20% of total rating): Car insurance rate estimates generated by Quadrant Details Provider and discount rate opportunities were both thought about - vehicle insurance. Protection (20% of overall score): Business that provide a range of choices for insurance protection are more most likely to satisfy customer requirements.

More About The Best Cheap Car Insurance Companies Of 2022 - Business ...

All it takes is a couple of clicks - cheapest.

Unfortunately, there's never a year-end clearance sale on cars and truck insurance. cheapest car insurance. Nevertheless, with some work on your part, you can still find the most affordable car insurance rate possible. 1. Shop Different Insurance coverage Carriers The very first and best thing you can do is contrast shop for automobile insurance coverage rates from various carriers.

Independent representatives usually sell policies for five to eight insurance coverage companies, enabling them to pick from among several choices to identify what is best for you. Recommendations from buddies and family members might likewise be practical in narrowing down your choices, specifically when it comes to the integrity of an insurance agent or company.

Raise Your Deductible If you carry just liability insurance, you will not have a deductible because this insurance covers losses you trigger other individuals to incur in a mishap. (A deductible is the quantity of cash you accept pay before your insurer will make any payment toward your own loss.) C&C protection does have a deductible.

"Consumer Reports recommends canceling your C&C protection if the premiums for it amount to 10 percent or more of your lorry's book worth. Continuing to spend for C&C coverage in that circumstance may extremely well trigger you to invest more on the coverage than you would get to fix or change your car - business insurance.

6. Consider PPM or Telematics Insurance If you do not drive lots of miles and are a cautious motorist, you could save some money with pay-per-mile (PPM) or telematics insurance. PPM programs are provided by Esurance and Metromile (trucks). Both companies utilize gadgets in your vehicle to track the variety of miles you drive each year.

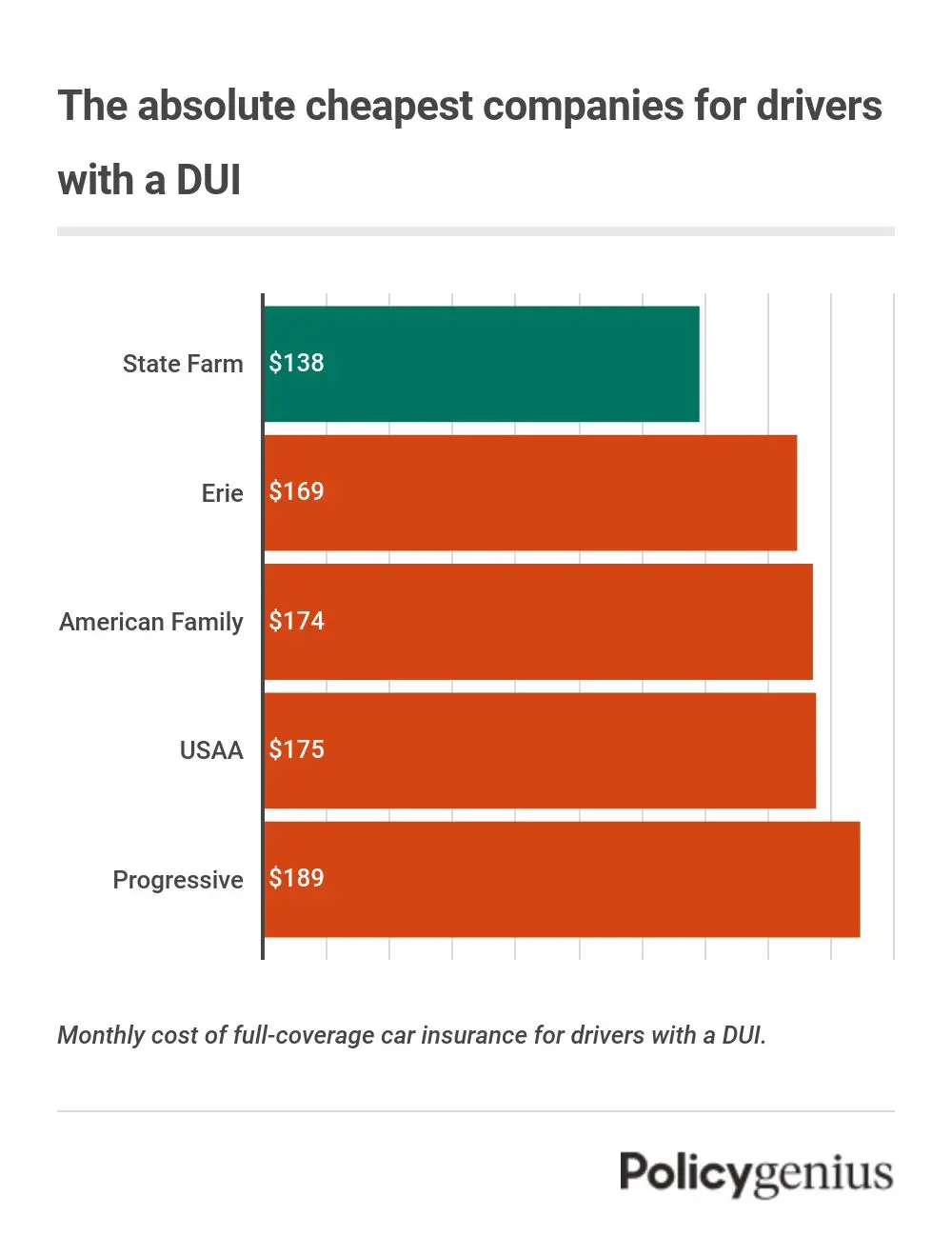

Keep a Clean Driving Record Safe motorists get some of the best rates, so getting the most inexpensive rate possible can result directly from your own actions. A speeding ticket may stay on your record for only five years, while a DUI will probably be on your record for a full decade. Improve Your Credit Score Great credit can likewise affect your insurance rates, and about 95% of automobile insurance business utilize your insurance credit rating when setting your premiums in states where it is legal to do.

Nationwide uses the following elements of your insurance credit rating when determining premiums: Your payment history, consisting of late payments and failure to pay, The length of your credit history, The types of credit in your history 9. Avoid Costs Some insurer charge you a cost each time you make a payment or they mail you an expense.

For instance, Farmers Insurance charges you as much as $2 if you do not receive bills via e-mail. And if you don't have your payment instantly subtracted from your checking account, this insurer might charge you up to $5. If you are late with a payment, you run the danger of having your coverage dropped and of getting struck with a charge.

Laws relating to the fees insurance providers can charge you differ by state. 10. Suspend Your Coverage of an Unused Automobile If you are not driving among your vehicles and strategy to keep it in storage for more than a month, you may cancel or temporarily suspend insurance for itthough some business allow you just to do the previous.

And if you're still making payments on the cars and truck, your loan provider might require you to keep insurance coverage under the terms of your loan contract. A better idea may be to suspend your liability and crash protection but keep your thorough coverage in case the cars and truck gets taken or harmed - cheapest car insurance.

Which business offers the most inexpensive car insurance in Florida? USAA, Geico and State Farm had the most affordable rates for the average Sunshine State vehicle driver, among carriers analyzed by's experts. However nobody's ideal, so do not fret if you do not fit the typical motorist demographic. No matter your circumstances, if you're searching for the most affordable cars and truck insurance in Florida, here you'll discover all the details you need to get the deals you desire without compromising protection.

To provide you a quote of what you can anticipate, we offer car insurance prices estimate for Florida chauffeurs for typical circumstances. These include vehicle drivers with the following: Accidents, Speeding tickets, Bad credit, Most affordable insurance for Florida chauffeurs with accidents, State Farm, Geico and Progressive had the least expensive car insurance rates in Florida for motorists with an at-fault mishap, among those surveyed by Insurance coverage.

Some Known Factual Statements About Cheapest Car Insurance Companies Of April 2022 - Time

Florida ranks 15th among the worst states for drivers with bad credit, based upon Insurance. com's data analysis. Compared to good credit chauffeurs, those in Florida with bad credit pay 74%more, on average. The bright side is that you can still shave some money off your protection expenses if you compare car insurance provider.

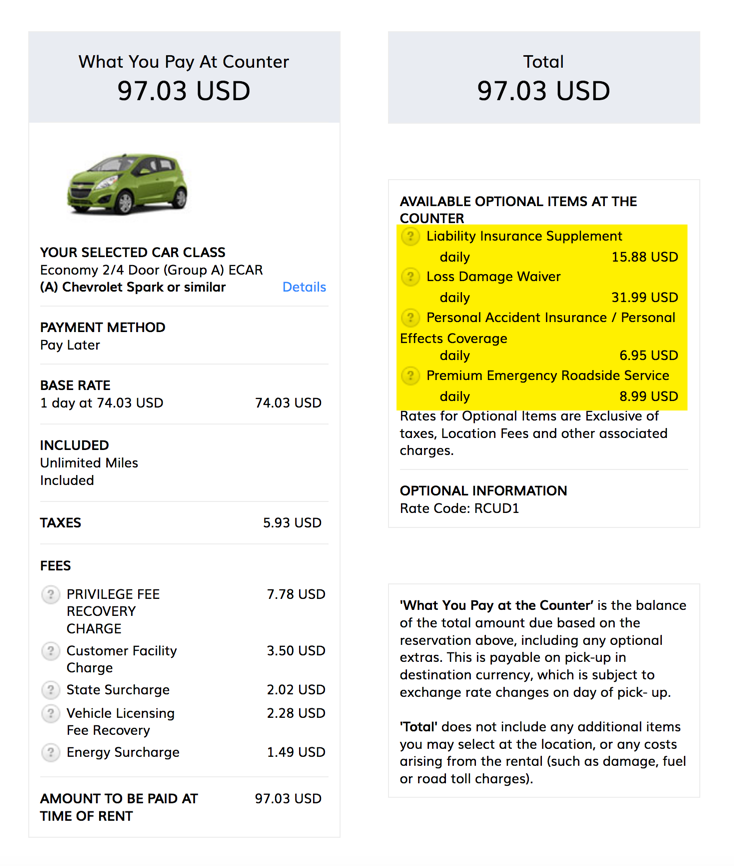

Some optional coverages you must include to make certain you have the very best automobile insurance coverage in Florida include: Bodily Injury Liability (BIL) pays for major and long-term injury or death to others need to you trigger a crash. If you have BIL insurance coverage, your insurance coverage business will not just spend for injuries up to the limits of your policy however it also will offer legal representation ought to you get sued. auto insurance.

Uninsured/underinsured vehicle driver (UM/UIM) coverage will offer you with additional protection if the other celebration doesn't have cars and truck insurance coverage. It's not compulsory coverage but when you think about that one in 4 drivers do not have vehicle insurance in Florida, it would be a good concept to include it. Buying detailed and crash protection is understood as "full coverage".

5 suggestions on how to save money on your automobile insurance coverage, Finding cost savings anywhere you can get them can make a huge distinction on your vehicle insurance. There are a few methods you can cut the expense of your premiums and still have the very best car insurance Florida protection. The very best car insurance provider in Florida have a range of ways you can minimize your coverage. insurance.

Before you sign up for protection, get at least a couple more quotes. The exact same kind of protection might vary in rate from one insurance provider to another. The automobile deductible is the amount you'll pay when you sue prior to the insurance coverage company pays the rest (risks). Think about raising the deductible greater to decrease your monthly insurance premiums.

Numerous insurance coverage providers will give you a considerable discount rate on your automobile insurance coverage if you finish an approved defensive driving or driver security course. The very best part is, the discount rate will get the next three years. Best cars and truck insurer in Florida, We took a look at the long list of cars and truck insurance coverage Florida carriers to narrow the list down to the best ones (insurance affordable).

Insurance coverage. All scores are out of 100.

The smart Trick of 10 Ways To Lower Your Car Insurance Costs - The Balance That Nobody is Talking About

If you relocate to Florida from another state, ask your insurance coverage agent if your business writes in Florida (most do) and to move your insurance coverage to Florida. You can search for insurance provider licensed to do company in Florida at the business directory site on the Florida Office of Insurance Regulation.

The registration fee is $225. To register your automobile: If you only live in Florida throughout the winter season, you still have to keep a valid car insurance plan in force. The state requires any vehicle with a Sunlight State license plate and registration to be covered by a Florida insurance coverage.

Some cars and truck insurance companies in Florida supply you with seasonal coverage be sure to ask your insurance provider about it. As long as the completed course is acknowledged by the Florida Department of Highway Security and Motor Vehicles, you'll be qualified to receive a discount rate on your vehicle insurance coverage, good for 3 years.

m. and 11 p. m. When you're 17, you can drive between 5 a - credit score. m. and 1 a. m. When you turn 18, all restrictions are eliminated.

To find out more, please see our and The typical car premium for medium sedans is $1,245 per year, AAA information shows. That's a good chunk of Americans' spending plans every yearand if you are looking to save money on automobile insurance, there are some caveats you ought to keep in mind. How much car coverage you have matters, too.

https://www.youtube.com/embed/6sqDWd-iR8U

It's simply as essential to be effectively covered in case your vehicle is harmed, taken, or even worse, if you get into a bad wreck - cheap car insurance. Once you understand just how much protection to purchase, among the finest ways to find cost effective auto insurance coverage without offering up quality protection is to compare rates and search for discount rates at several companies.

The Liability Car Insurance: What It Covers & How Much It Costs Statements

.ashx)

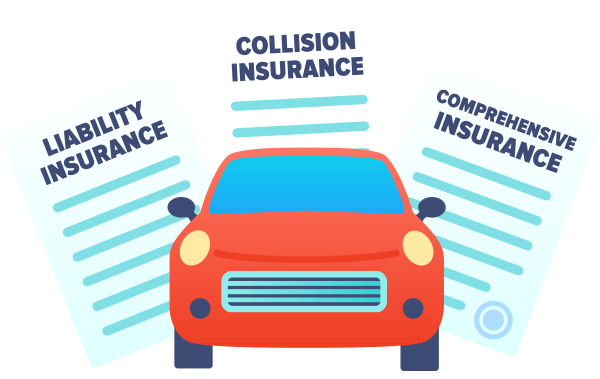

When you buy car insurance policy, you pick the coverages you desire and the restrictions or deductibles for each and every. The even more insurance coverage you choose, the a lot more defense you'll have, yet your prices will certainly be higher too. Bodily injury responsibility, Medical costs if you've injured someone in an accident, Residential property damage responsibility, The cost of home damages you've caused in an accident, Injury defense, Medical expenditures for you or your travelers after a mishap, Uninsured/underinsured driver, The prices if you're in an accident brought on by a vehicle driver with little or no vehicle insurance coverage, Comprehensive, Damages to your car that happens when you're not driving, Crash, Damage to your vehicle after an automobile crash, no matter that was at mistake, What does obligation insurance cover? Liability insurance coverage covers the expenses you are accountable for when you cause a mishap.

To use liability protection, the victim, suggesting the various other chauffeur, will certainly file an insurance claim with your cars and truck insurance policy, who will work with that individual to ensure their damage is spent for. insurers. What does accident security (PIP) cover? Injury security (PIP), likewise called no-fault insurance coverage, assists cover the expenses when you or any one of the guests in your automobile are harmed in a crash.

That consists of damages from: Collapsing right into another automobile, Running right into a fixed things, like a tree, Driving over a crater, What does void insurance cover? When your vehicle is swiped or ruined, your auto insurance coverage will certainly pay for the actual cash value of your cars and truck. If you car loan or rent your car, as well as it's completed in a mishap, you can end up owing a lot more on your funding or lease than your cars and truck's diminished worth - accident.

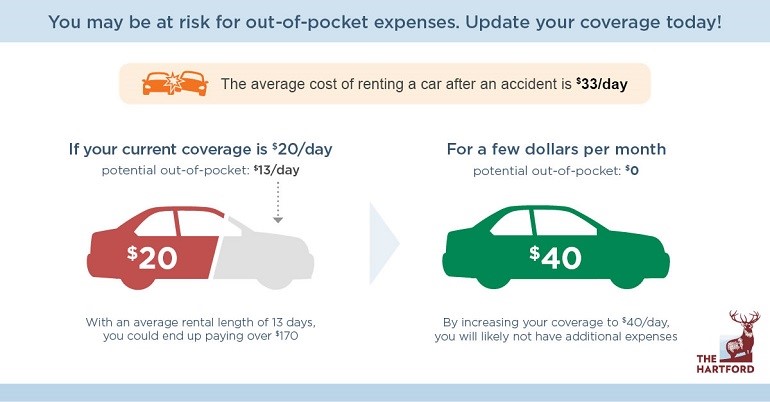

New auto substitute protection pays to replace your completed cars and truck with among a comparable make as well as version, yet it's typically only available if your cars and truck is much less than two years old. accident.Rental reimbursement protection: When your car is being repaired in a shop, rental compensation coverage can spend for a rental auto in the meanwhile.

.ashx)

What does vehicle insurance not cover? Your vehicle insurance coverage will certainly tell you what type of accidents as well as damage are covered in addition to what isn't. Automobile insurance typically does not cover: Normal repair work: Repair services that result from regular damage as well as upkeep problems are not covered, so regular oil changes or a dripping radiator would not be covered by car insurance policy.

Contact your insurance firm to see whether you can get coverage for your Lamborghini, but you may discover you have to go shopping at specialized insurance providers as well as get a separate plan totally. low-cost auto insurance. Specific dangers: Some causes of damages are not covered, including intentional damages, damage from street auto racing or damages from acts of battle.

8 Easy Facts About The Role Of Insurance In A Car Accident Case - Nolo Shown

Will my insurance go up after an insurance claim? Yes, your cars and truck insurance coverage rates may rise after a case. At-fault mishaps are nearly guaranteed to increase https://ideas-cutting-car-insurance-costs.eu-central-1.linodeobjects.com your prices, yet your insurance policy can even rise for a not-at-fault case. If you learn your prices are going up due to a case, it might be a great time to reshop your automobile insurance and see if you can discover a lot more budget friendly insurance coverage elsewhere.

Suing can trigger your prices to rise, so if the expense of fixing the damage to your own car is much less than or equal to your deductible, then you shouldn't sue and also risk increasing your prices. low-cost auto insurance. If one more driver was involved in the accident, you need to always notify your insurance companies the various other cars and truck might have more damages than is visible at the scene of the accident, or the driver might have an injury that isn't noticeable until later.

You as well as relative provided on the plan are also covered when driving a person else's car with their authorization. It's very vital to have adequate responsibility insurance policy, since if you are associated with a severe crash, you may be filed a claim against for a large amount of money. It's suggested that insurance holders buy greater than the state-required minimum responsibility insurance coverage, enough to protect possessions such as your house as well as financial savings.

At its broadest, PIP can cover medical settlements, shed wages and also the cost of replacing services typically carried out by someone wounded in a vehicle mishap. It may also cover funeral costs. Building damage responsibility This coverage pays for damages you (or a person driving the cars and truck with your permission) may trigger to somebody else's building.

what does car insurance cover

what does car insurance cover

Accident Crash coverage pays for damage to your auto resulting from a collision with one more automobile, an item, such as a tree or utility pole, or as an outcome of flipping over (note that crashes with deer are covered under extensive). It likewise covers damages caused by holes (insurance companies). Crash protection is normally marketed with a different deductible.

If you're not liable, your insurer may attempt to recoup the quantity they paid you from the other chauffeur's insurance business as well as, if they succeed, you'll likewise be repaid for the deductible. Comprehensive This coverage repays you for loss because of theft or damages triggered by something other than a crash with another cars and truck or object.

The Main Principles Of About Car Insurance Coverage Types - Liberty Mutual

Looking for vehicle insurance coverage? Below's how to find the appropriate policy for you as well as your cars and truck. cheapest..

Automobile insurance policy can not maintain you from entering a crash, yet it can assist pay the significant clinical expenses and fix prices that originate from a serious wreck. Just how much your plan will pay depends on the kinds of car insurance you get and the limits you select (dui). Below's a guide to protection choices.

Exactly how vehicle insurance policy functions, Most auto plans include several types of automobile insurance coverage, each designed to pay for different expenditures. As an example, one part of your policy could cover repair services for your automobile, while one more pays for somebody else's damages. Each kind of protection has a limit the maximum your plan will pay.

what does car insurance cover

what does car insurance cover

The greater your limitations and the even more kinds of protection you purchase, the less economic duty you're most likely to encounter after an accident however the extra costly your insurance will certainly be. To determine what coverage you need, investigate what's required in your state and what will best secure your funds.

While minimum car insurance policy demands vary by state, the primary kinds of insurance protection you could be required to obtain are: Obligation insurance coverage, which spends for costs as a result of an accident you create. Accident security, or PIP, or clinical payments, or Medication, Pay, to cover your own medical expenditures after a mishap, despite that's at fault (laws).

If you had actually the insurance coverage noted above as well as created $100,000 worth of injuries to four different people, those clinical costs wouldn't be entirely covered since your per-accident optimum is $300,000 - credit. To make this type of circumstance much less most likely, in some states you can select a consolidated single limit instead. PIP and also Medication, Pay, Injury security and medical repayments protection pay your very own clinical expenditures after a vehicle accident, regardless of who was at fault.

Not known Factual Statements About Does Car Insurance Follow The Car Or The Driver? - Getjerry.com

Concerning 1 in every 8 chauffeurs don't have automobile insurance, according to a 2019 research study by the Insurance policy Research Council. Some states need a minimum quantity of without insurance or underinsured driver coverage. Right here are 4 coverage kinds that might be required: Without insurance motorist bodily injury coverage, or UMBI, pays for medical expenses triggered by a without insurance vehicle driver.

Underinsured driver physical injury protection, or UIMBI, pays if the price of injuries and also fixings is even more than an at-fault chauffeur's physical injury liability limits. Underinsured driver residential or commercial property damages insurance coverage, or UIMPD, spends for fixing prices that surpass the at-fault motorist's home damage obligation limitations. Just how it functions: A vehicle driver rear-ends you at a traffic signal.

Usually, the auto dealer will certainly supply the space insurance coverage, and also the cost will certainly be consisted of as component of the lease payment. That results in paying passion on insurance coverage you can commonly obtain less expensive with an insurer. Just how it functions: You owe $20,000 on your automobile lending when you enter into a negative crash as well as your new automobile is completed.

4 auto coverages you most likely don't learn about Most policyholders understand the fundamentals (auto insurance). Certain, vehicle insurance policy spends for damage created by an at-fault auto accident. Yet auto insurance coverage is a complex instrument with a myriad of protections and also situations, usually relying on what details types of insurance coverage an insurance policy holder selects.

Does cars and truck insurance cover hail damages? Some vehicle insurance plan will cover hailstorm damages - trucks. Those with comprehensive car plans are in good luck. Detailed policies cover automobile damages that doesn't result from an accident or mishap. Extensive insurance policy covers damage from events like hail, floodings, theft as well as criminal damage. Hail damages is something to fret about.

Hail storm damages can influence an auto's resale worth. Generally the panel damage isn't a practical issue yet a visual one. For smaller dents and also dings, a body shop can occasionally bulge the dents without influencing the paint. For extreme or extensive damages, they may suggest replacing vehicle panels (liability). The insurance firm and also repair service shop can encourage what's required on a case-by-case basis.

The Ultimate Guide To About Car Insurance Coverage Types - Liberty Mutual

Maintain in mind that deductibles still use to the insurance coverage company payouts. Insurance policy holders will certainly enjoy to know that their rates will not be influenced by the case, as it's an all-natural occasion, not one triggered by the vehicle driver. That claimed, if hailstorms are an usual event, consumers need to take into consideration, as a general practice, keeping cars and trucks in a garage or covered carport for security, when possible. car insurance.

It might be a driving accident on a freeway or hitting a parked automobile. A number of kinds of insurance may use to a hit-and-run mishap, consisting of accident insurance policy, uninsured and underinsured motorist insurance coverage, as well as liability insurance.

what does car insurance cover

what does car insurance cover

In some states, without insurance driver insurance coverage is required, while in others, insurance providers are called for to offer the protection, yet a vehicle driver does not have to purchase it.

They even cover pedestrians, if they're hit by a person without sufficient insurance policy. Does auto insurance coverage cover various other vehicle drivers?

They would also be covered if driving the policyholder's cars and truck as well as they're hit by a person without necessary insurance policy protection. That might trigger the uninsured or underinsured motorist insurance coverage.

https://www.youtube.com/embed/4Ofv8WlnIH8

That indicates the automobile or individuals they strike aren't the insurance holder's duty. The policyholder's auto, nevertheless, would likely still be covered. If an automobile proprietor provides consent to somebody to borrow his/her car which individual has a mishap, it's feasible for the motorist to still obtain their insurer entailed.

All about Ford Focus St Car Insurance Cost For 17, 18, 19 & 21 Year Old ...

If you're away at university for many of the year, you possibly do not place also lots of miles on your auto. Rather, you may invest more miles on mass transit, ride-sharing, or your bike. With pay-per-mile insurance policy, you don't spend for miles you do not drive. College and student motorists can pay less than other chauffeurs that may need to commute far distances for job or drive more on a regular basis.

When it comes to insurance coverage, there's something to be said for driving experience. Insurance policy business utilize factors like mishap stats when mentioning rates for young motorists, as well as the younger the driver, the most likely they're going to get in a crash - cheapest. For that reason, 19-year-olds pay greater rates than lots of older drivers, however there are still some techniques you can use to help conserve money.

For 19-year-old vehicle drivers looking to obtain insured on their very own, the prices get on the costly side, however they're still most likely going to be less than what you could see for a 16-year-old vehicle driver in the same placement. The younger driver would pay an average of regarding $2,500 more than a 19-year-old.

Least Expensive Car Insurer for 19-Year-Old Chauffeurs, Firms make use of lots of elements when setting car insurance rates, as well as for 19-year-old drivers who do not have the benefit of a recognized driving background, costs can obtain quite high. Nevertheless, there will still be variations from business to business as every one utilizes a special collection of requirements and information points to figure out rates.

Scroll for extra Contrast Insurance Policy Rates, Guarantee you are obtaining the best price for your insurance coverage. Auto Option Issues When Insuring a Young Driver, One of the aspects insurance companies take into consideration when setting prices is the type of cars and truck that's being insured. insurers.

Getting The How Much Does A 19 Year Old Pay For Insurance On A ... To Work

The Insurance Coverage Institute for Freeway Safety And Security is a great place to start your search for the best cars and trucks. Strategies to Conserve Money on Cars And Truck Insurance Policy for a 19-Year-Old, Although it can be expensive for a 19-year-old to get their own insurance coverage, there are methods you can make use of to minimize the expenses.

Here are a few other suggestions to take into consideration: Contrast Quotes for the Best Policy, As noted above, the most effective vehicle insurance policy for a 19-year-old will certainly vary based on many aspects. That's why it is essential to contrast quotes if you can. That way, you'll comprehend your alternatives as well as are much better prepared to choose the very best policy for you.

Contrast Auto Insurance Policy Fees, Guarantee you are getting the finest rate for your automobile insurance coverage. Compare quotes from the leading insurance coverage business.

business insurance car car insurance insurers

business insurance car car insurance insurers

Even if these training courses don't line up with a discount rate at your insurer, they can still convert to financial savings in time. Reduced the Coverage Amount, Decreasing the coverage amounts Take a look at the site here like choosing for liability-only auto insurance will reduce your car insurance coverage price. This can be an excellent option for vehicle drivers with a cost-effective car. cheap insurance.

As an example, if you were to get in an accident, you normally would not be covered for damages to your lorry, which could lead to costly fixing bills in the future. Pick a Sedan Over a Sports Vehicle, Some automobiles are going to cost you even more to insure than others. Sports and deluxe cars and trucks are generally on the greater end of the range to insure a Mustang will normally cost even more than a Camry.

Some Known Details About How Much Is Car Insurance For A 16-year-old ... - Financebuzz

Why Is Car Insurance Policy So Costly for a 19-Year-Old? Younger chauffeurs don't have the benefit of a long, tried and tested driving record to help them save cash on vehicle insurance coverage. That means insurance companies resort to ordinary driving stats for 19-year-olds to approximate the probability of those chauffeurs getting involved in a crash.

Web Traffic Data for 19-Year-Old Drivers, As a whole, the stats claim that chauffeurs tend to get involved in fewer accidents as they age. Consequently, a 16-year-old is most likely to enter into a mishap than a 19-year-old, while somebody in their very early twenties is much less most likely to experience a mishap than either of those younger vehicle drivers.

If feasible, driving much less is both safer as well as less costly. One option to consider is capitalizing on 'far from home' price cuts which typically compensate young motorists that are away at university, without their auto. Contrast Car Insurance Fees, Ensure you are getting the best price for your auto insurance coverage.

Your own costs might differ. The quickest means to locate out how a lot an auto insurance plan would certainly cost you is to make use of a quote calculator device.

cheapest car insurance cheaper cars cheap auto insurance risks

cheapest car insurance cheaper cars cheap auto insurance risks

cheapest vehicle insurance affordable auto insurance trucks

cheapest vehicle insurance affordable auto insurance trucks

Various states also have different driving problems, which can affect the expense of car insurance - cheap car. To give you some concept of what drivers in each state invest yearly on auto insurance, the table listed below programs the average expense of auto insurance policy by state, according to the 2021 NAIC Car Insurance Database Report.

Getting The How Much Is Car Insurance? [2022 Cost Guide] - Marketwatch To Work

Bundling: Bundling your home as well as automobile insurance policies normally results in premium discounts. You can also save cash for insuring several lorries under the same plan.

Our technique Since consumers depend on us to offer unbiased and exact info, we developed a thorough rating system to formulate our positions of the very best auto insurance provider. cheap. We collected data on lots of vehicle insurance policy suppliers to grade the companies on a wide variety of ranking factors. The end result was a total score for each carrier, with the insurance firms that scored one of the most points topping the listing.

Schedule: Automobile insurance coverage business with better state schedule as well as few qualification demands racked up highest possible in this classification. Protection: Companies that offer a selection of options for insurance protection are much more most likely to meet consumer demands. Price: Typical car insurance policy prices and also price cut opportunities were both taken right into factor to consider.

, this age team is involved in even more auto crashes than any type of various other.

How How Much Does Auto Insurance Cost For A 19-year-old In Ny? can Save You Time, Stress, and Money.

How to Save Cash on Auto Insurance Coverage for a Teenager Motorist:1. Place your adolescent motorist in a secure vehicle.

For a $2,400 policy, that could translate to a cost savings of as much as $600! In order to get approved for a "Great Grade" discount, the motorist is normally required to keep a "B" average while being registered as a full time trainee. Note that not all insurance companies supply this discount rate. auto. The ones that do base their discount rate on the fact that teens with good grades often tend to be much better as well as much safer chauffeurs.

So while you'll be tackling the added cost of another chauffeur (and a "dangerous" one, at that) you will all be saving cash in the long run. Incidentally: Even if your adolescent driver does not have their very own specific plan does not indicate you can't ask them to pay for some or every one of the costs to guarantee them.

Store around for Vehicle Insurance policy with free quotes. In the insurance policy globe, it never ever harms to ask.

Ask away! Obtain a cost-free quote on car insurance with no responsibility to acquire. 7. The best cost savings: SECURE DRIVING! We're enthusiastic concerning assisting you obtain the best coverage for the right price yet your safety and security is our top priority. It do without saying that the finest method to conserve money on auto insurance coverage at any kind of age is to have a tidy, safe driving record without accidents and also previous cases for cars and truck damage.

The Only Guide for Ontario Couple Who Didn't Buy Insurance Denied Refund After ...

Saving Cash on Teen Automobile Insurance Policy Policies So you have actually got your brand-new motorist's certificate as well as, as you're possibly conscious, it's prohibited to strike the roads without vehicle insurance. You possibly likewise know that insurance prices are based on just how likely you are statistically to obtain right into an accident. As a novice driver, the numbers aren't on your side.

There are some things young adults and also parents can do to conserve cash on insurance policy prices. Hop on your parents' policy. It's generally cheaper to add a young adult to their moms and dads' policy, instead of be insured individually. The majority of firms will not charge an additional costs till the teenager is a licensed driver (car).

Calculated cover-up can affect insurance coverage (cheapest car insurance). Excellent qualities repay. Many insurers supply a price cut, some as high as 25%, for students who keep a B average. Chauffeur experience. Finished Vehicle driver Licensing legislation requires teenagers to log 50 hrs with a knowledgeable motorist, however taking an official vehicle drivers educating program will likely save on insurance policy.

Penalties can land you back in the guest seat. Fatality and also injury are the highest possible cost drivers can spend for drinking and driving, yet also if you manage to make it through, a D.U.I. ticket will set you back young adults majorly. As a teen motorist, you'll likely be terminated and if you can get insurance coverage, expect to pay a much greater price for the following 3-5 years.

Drive an "insurance policy friendly" car. Autos that are a favored target for thieves, are expensive to fix, or are taken into consideration "high efficiency" have much higher insurance coverage expenses.

Examine This Report on How Much Is Auto Insurance For An 18-year-old?

Frequently Asked Questions Concerning Auto Insurance A.

The highest insurance rates are paid by any male motorist under the age of 25. His price then rests on whether he's married and also whether he possesses or is the major motorist of the car being insured. With the boost in young female drivers in the last twenty years, however, the mishap rates between the genders are evening out.

Saving Cash on Teenager Auto Insurance Coverage So you've obtained your brand-new chauffeur's certificate and also, as you're probably aware, it's illegal to strike the roads without automobile insurance coverage. You possibly additionally understand that insurance policy rates are based upon just how likely you are statistically to get into a collision. Unfortunately, as a new driver, the numbers aren't on your side.

But, there are some points teenagers and also moms and dads can do to save money on insurance prices. Hop on your parents' policy. It's usually less expensive to include a teen to their moms and dads' policy, instead than be insured independently. Most business won't charge an extra costs until the teenager is a licensed motorist.

Motorist experience. Finished Chauffeur Licensing legislation needs teenagers to log 50 hrs with a skilled motorist, yet taking a formal motorists training program will likely save on insurance.

The Single Strategy To Use For Medical Assistance General Eligibility Requirements - Pa ...

Charges can land you back in the passenger seat. Fatality as well as injury are the highest rate vehicle drivers can pay for alcohol consumption as well as driving, but even if you handle to endure, a D.U.I. ticket will certainly cost teens large time. As a teen chauffeur, you'll likely be cancelled and also if you can obtain insurance policy, anticipate to pay a much higher price for the following 3-5 years.

Drive an "insurance policy friendly" vehicle. Autos that are a preferred target for thieves, are expensive to fix, or are thought about "high performance" have a lot greater insurance expenses.

Some insurance business such as SAFECO deal technology to assist parents track teen chauffeur behavior such as worldwide placing systems (GENERAL PRACTITIONERS) which record where an automobile is driven and also just how fast. American Household companions with a company that installs in-vehicle video cameras to check driver actions. Generally Asked Inquiries Concerning Vehicle Insurance Policy A - auto.

insurance affordable vehicle insurance business insurance automobile

insurance affordable vehicle insurance business insurance automobile

https://www.youtube.com/embed/1fUlZVipfFs

The highest insurance coverage prices are paid by any kind of male chauffeur under the age of 25. His rate after that depends upon whether he's married as well as whether he owns or is the major vehicle driver of the auto being insured - trucks. With the increase in young female chauffeurs in the last twenty years, nevertheless, the crash rates between the genders are night out.

The 20-Second Trick For Pay-per-mile Car Insurance: A Guide (Updated April 2022)

Edit your About page from the Pages tab by clicking the edit button.

Pay-per-mile Insurance - Coverage.com Things To Know Before You Get This

Edit your About page from the Pages tab by clicking the edit button.

Some Known Factual Statements About Pay-per-mile Car Insurance - Lewis Insurance And Financial

Edit your About page from the Pages tab by clicking the edit button.

Pay Per Mile Insurance - Financeguru.com Fundamentals Explained

Edit your About page from the Pages tab by clicking the edit button.

More About Here's Why Pay-per-mile Car Insurance Might Be For You

Edit your About page from the Pages tab by clicking the edit button.

A Biased View of Pay Per Mile Car Insurance - How Does It Work?

Edit your About page from the Pages tab by clicking the edit button.

Some Known Facts About Eric Insurance Explains The Top Considerations When ....

The entire feature of insurance policy is not always to have the cheapest costs, but to have the coverage you require if something goes incorrect as well as these companies all master that respect." Technically, USAA had the highest rating in every region of the nation, according to J. auto insurance.D. Power's newest study on vehicle insurance coverage.

And that goes to the actual heart of the drawback with USAA. You have to be an expert, presently offering in the U.S. army or affiliated with the military through direct family ties to be eligible for solutions USAA offers. While it supplies fantastic car insurance policy protection, that might eliminate USAA from factor to consider for a lot of people.

Unlike USAA, Amica Mutual has no fabricated barriers to entry. However since Amica Mutual is a mutual company, insurance coverage prices tend to be extremely pricey during your very first year as a consumer. When you join a shared vehicle insurer like Amica, there are no shareholders as there are with other public companies.

That first year, with the higher in advance expenses, you're basically getting into the company. Afterwards, clients commonly obtain an yearly premium rebate equivalent to about 20% of what they paid that year, subject to exactly how the company is doing economically. As a mutual business, New Jacket Manufacturers Insurance Provider (NJM) became the very first firm to make the J.D. vehicle insurance.

The most recent study, performed in between 2016 and also 2020, asked greater than 56,000 readers regarding their complete satisfaction with the cases process, the cost of costs and the total customer experience with a variety of insurance providers. Nevertheless, consumer solution, insurance policy prices as well as cases fulfillment can make a great difference for an auto insurance provider.

You'll see a different number of access depending on which component of the country the business operate. Resource: J.D. Power U.S. Auto Insurance coverage Research study In addition to its regional positions, J.D.

money cheaper insurance auto

money cheaper insurance auto

Working with an insurance policy broker is one more choice.

Once you obtain the quotes, it's time to compare them. Each quote ought to be based on the exact same quantity of insurance coverage so you can do an apples-to-apples contrast. One tip: If you own a residence, have cash in cost savings, etc, you most definitely desire greater than the state minimums for obligation.

The 9-Second Trick For 10 Cheap Car Insurance Plans For Young Adults - Good ...

If you have no considerable properties and you rent a residence as opposed to owning one, after that the state minimum level of insurance coverage is acceptable. money. If you're truly price-sensitive and also locate that all the top-tier insurance firms are as well expensive for your spending plan, you still have a number of alternatives: Increase your insurance deductible.

The decision on purchasing automobile insurance boils down to more than simply cost. You've additionally got to consider client fulfillment as well as complaints and a company's track record for making its consumers whole which is the point of insurance coverage in the initial location. At the end of the day, hearing regarding a positive or unfavorable customer support experience can aid your choice in selecting an insurance coverage supplier.

"Occasionally you're much better off paying a little more to be with a top quality insurance company who will certainly be there when the chips are down," Clark states.

Last Decision Numerous car insurance provider available may supply the coverage you need. They might not offer the least expensive price or the best protection, which is why it is important to go shopping and also contrast your options. Based on our expert analysis, we chose State Farm as the general finest cars and truck insurer for 2022.

: Lots of auto insurance coverage business supply numerous methods to save, such as price cuts for safe motorists, university student, or army members.: A lot of insurance provider cover the fundamental extensive and also crash coverage, however there are likewise other, specific insurance coverages that might not be so typically located, such as electric or vintage car insurance.: Each sort of coverage features a maximum limit that reveals specifically how much of your losses will certainly be covered by your insurer - insurance.

More About Best Car Insurance Companies For May 2022 - Policygenius

auto insurance automobile cheaper cars

auto insurance automobile cheaper cars

What Does Vehicle Insurance Coverage Cover? Car insurance covers damage to your lorry, as well as other automobiles or residential property if you're included in an accident. What Are the Various Types of Vehicle Insurance?

For further information regarding our choice criteria and process, our complete method is available.

Whether you are a new shopper checking out obtaining an automobile insurance plan for your brand-new auto or you are someone that is taking a look at changing to a new firm, among the most critical things before you begin on the procedure of speaking to insurance policy business is to initially do your own research study (perks).

When you collect this information, it is important to consider some of the car insurance provider you want online as well as compare them. Specifically, shoppers must take a look at their coverage needs liability, which is called for by many states, full coverage/comprehensive insurance policy (vital as well as needed if your cars and truck is funded), without insurance as well as underinsured motorist protection, collision coverage, injury defense insurance, and so on (cheap insurance).

Obligation insurance policy is mandated by a lot of states, Collision insurance policy covers you despite fault, Comprehensive/full coverage insurance policy covers you in case of damages to vehicles triggered by unforeseen disasters or "disasters"-- events such as hail storm or a fallen tree arising from severe climate condition, or your cars and truck striking an animal, and so on. cheaper car insurance.

Things about The 10 Best Car Insurance Companies Of May 2022

Taking liability-only car insurance is fairly risky. It might function well in specific situations for an individual who has economic constraints wanting to conserve cash, provided they do not have any loan on the car, or if the value of the auto being insured is very reduced (such as if the insurance policy price is higher than the value of the cars and truck.

Full protection car insurance fees will differ for every consumer depending on their credit rating as well as driving as well as accident history. Therefore, each individual's situation is one-of-a-kind. If you are a brand-new motorist or teenage vehicle driver and even a person that is risk-averse, after that it is much better to take comprehensive, accident, and uninsured/underinsured, in addition to clinical settlements protection and also personal injury defense, in enhancement to the responsibility insurance coverage that many states mandate.

Several firms will certainly be pleased to obtain your organization and also looking at creating a long-term partnership with brand-new clients.

Best vehicle insurance policy firms The top-scoring auto insurance carrier overall was Geico, reporting high customer fulfillment levels in all regions of the country. This insurance coverage service provider is also ranked among the least expensive vehicle insurance coverage suppliers (and also a premium can be a huge expenditure).

Geico's clever commercials have made it one of the best-known cars and truck insurance provider in the country, and it ranks high in overall client contentment as well as car claims fulfillment, according to J.D. Power studies. It gets fewer consumer issues than other significant insurers, as well as has the greatest monetary stamina score from AM Ideal.

Things about Eric Insurance Explains The Top Considerations When Looking

That claimed, USAA is one of one of the most cost-efficient insurance firms available, providing prices that also beat Geico's. Consumers that change conserve approximately $725 a year. If you bundle home and also vehicle insurance policy (or renters and also automobile insurance), you can save up to 10%. The Hartford The Hartford is an insurance policy service provider offering outstanding protection and also excellent customer care, but it isn't for all vehicle drivers.

vehicle insurance credit score insure car insured

vehicle insurance credit score insure car insured

Frequently asked questions What's the best auto insurance? Geico, Travelers, USAA, The Hartford and also Amica are our leading car insurance coverage selects for many drivers.

For instance, while State Ranch boasts high car cases complete satisfaction scores, they additionally have extra than 1. 5 times the sector requirement in consumer grievances, according to the National Organization of Insurance Commissioners. Furthermore, we've compiled added checklists based upon different metrics. Review our finest auto insurance coverage referrals for most Find out more inexpensive auto insurance policy, armed forces members as well as teenagers as well as young drivers (cars).

When purchasing for vehicle insurance, you'll notice that rates differ by region and that state legislations determine which insurance coverage is needed on your policy as well as what the minimal restrictions are. There are plenty of great insurance provider that operate regionally or only in a pick amount of states.

Auto-Owners provides insurance coverage in just 26 states, while Erie uses it in just 12. What kind of insurance coverage does your state lawfully require you to have? In the majority of states, physical injury obligation coverage as well as home damage obligation are essential to drive, however you'll wish to check the specifics of insurance policy costs with auto insurance coverage service providers where you live.

The Single Strategy To Use For Metlife: Insurance And Employee Benefits

Note that this listing does not consist of all kinds of coverage used by carriers-- these are simply the most typical. Obligatory protection: Simply regarding all states need the two kinds of protection listed below, which do not cover damage to your very own auto or property.: This insurance coverage pays for injuries to others caused by the policyholder and various other vehicle drivers provided on the plan.

If your car is funded, your loan provider might require you to carry full insurance coverage, meaning both extensive as well as accident. This protection pays for damage to your lorry in a mishap arising from a collision between your car and also one more automobile or an object. cheaper auto insurance.: This protection pays for damages to your automobile brought on by an event besides collision.

Nevertheless, we may receive settlement when you click on web links to items or services provided by our partners - cheap insurance.

Power general cases complete satisfaction ranking: N/An Alternative best vehicle insurance policy business for young chauffeurs: State Farm If you're a young driver, after that you might not want an insurance firm tracking your driving habits. Because situation, you ought to search for an insurer that often tends to have low rates for young drivers. money.

However, they will not all punish you equal. Farm Bureau increases prices by 34% when motorists have an at-fault mishap in their current history 6% much less than standard. Using prices pulled from around the nation, we discovered that Ranch Bureau just raises costs by $534 annually for a full coverage policy after a mishap.

More About Progressive: An Insurance Company You Can Rely On

The very best cars and truck insurance coverage companies in California are The General, Direct Vehicle and also PURE Insurance policy. The best car insurance firms in The golden state can conserve drivers numerous bucks annually, while supplying standout protection and also client service. Simply put, it pays to be well-protected when driving in the Golden State.

reveal extra, Page 1 of 3Next, View More Insurer, The most effective auto insurance in California is from The General since customers usually provide The General favorable evaluations. The General has a user ranking of 4 (insurers). 2 out of 5 on Wallet, Hub, in addition to a score of 1.

https://www.youtube.com/embed/gsfTnV1Da1w

Various other customers have a wealth of understanding to share, and we urge every person to do so while respecting our web content guidelines. Please bear in mind that content and also user-generated material on this web page is not examined or otherwise endorsed by any kind of monetary institution. Furthermore, it is not the monetary organization's obligation to guarantee all blog posts and also questions are addressed.

Excitement About How Much Does Car Insurance Cost, On Average? - Money ...

If the worth of the automobile is just $1,000 and also the collision protection costs $500 per year, it might not make feeling to get it. GEICO, for instance, supplies a "potential cost savings" of 25% if you have an anti-theft system in your auto.

Automobile alarms and also Lo, Jacks are 2 types of devices you might wish to inquire around. If your main inspiration for installing an anti-theft device is to lower your insurance coverage premium, consider whether the price of adding the device will certainly lead to a substantial enough cost savings to be worth the problem and also cost - read more vans.

Speak with Your Agent It's vital to note that there might be other expense financial savings to be had in enhancement to the ones explained in this short article. That's why it commonly makes sense to ask if there are any kind of unique price cuts the business supplies, such as for military personnel or employees of a particular company (auto insurance).

There are many points you can do to reduce the sting. These 15 suggestions must obtain you driving in the best direction. Bear in mind likewise to compare the best cars and truck insurer to find the one that fits your insurance coverage requirements and also spending plan.

The smart Trick of How Much Does Car Insurance Cost On Average? - The Zebra That Nobody is Talking About

Insurance policy service providers desire to see demonstrated liable habits, which is why web traffic accidents and citations are consider identifying auto insurance coverage rates. Keep in mind that points on your permit do not remain there permanently, yet exactly how lengthy they remain on your driving document differs depending upon the state you stay in as well as the seriousness of the crime.

insurers credit cheaper car credit

insurers credit cheaper car credit

A new sporting activities cars and truck will likely be much more expensive than, state, a five-year-old sedan. If you select a reduced deductible, it will certainly result in a greater insurance policy costs that makes choosing a higher insurance deductible appear like a respectable offer. A greater insurance deductible could suggest paying more out of pocket in the occasion of an accident.

What is the typical automobile insurance policy cost? There are a wide range of variables that influence just how much automobile insurance policy costs, which makes it tough to obtain a precise idea of what the typical individual spends for auto insurance coverage. According to the American Automobile Association (AAA), the average price to insure a sedan in 2016 was $1222 a year, or roughly $102 each month - cheap car insurance.

Nationwide not just supplies competitive prices, but likewise a variety of discounts to aid our participants save a lot more (cheapest). So, how do I obtain auto insurance coverage? Obtaining a car insurance quote from Nationwide has actually never been simpler. See our car insurance quote section and enter your postal code to start the auto insurance policy quote process.

Top Guidelines Of What Is The Average Cost Of Auto Insurance? - Moneygeek

55 in 2018 (one of the most current year covered in the report). However, your own prices may vary. The quickest way to discover just how much a vehicle insurance plan would cost you is to utilize a quote calculator tool. Enter your zip code listed below to obtain cost-free, instantaneous insurance coverage quotes from several of the best vehicle insurance policy firms in your location.

Various states likewise have different driving problems, which can influence the expense of vehicle insurance (cheapest car insurance). To offer you some idea of what vehicle drivers in each state invest annually on auto insurance policy, the table below programs the typical cost of vehicle insurance by state, according to the 2021 NAIC Automobile Insurance Coverage Data Source Record.

Bundling: Bundling your residence as well as auto insurance coverage typically leads to costs discounts. You can additionally conserve cash for insuring numerous cars under the exact same plan. Paying in advance: Many insurance providers supply a pay-in-full discount - car insurance. If you have the ability to pay your whole costs at when, it's commonly an extra cost-effective choice.

auto insurance affordable prices laws

auto insurance affordable prices laws

Our technique Due to the fact that customers depend on us to provide unbiased as well as precise information, we developed a detailed rating system to develop our rankings of the finest auto insurance companies. We accumulated information on dozens of vehicle insurance policy carriers to quality the firms on a large range of ranking variables. Completion result was a total rating for each and every supplier, with the insurance firms that scored the most factors covering the listing (cheapest car insurance).

4 Easy Facts About How Much Does Car Insurance Cost Per Month? Explained

Schedule: Vehicle insurance provider with better state schedule and also couple of qualification requirements racked up greatest in this category. Insurance coverage: Business that provide a range of choices for insurance policy protection are much more most likely to meet customer requirements - low-cost auto insurance. Cost: Ordinary car insurance rates as well as discount opportunities were both considered. insurers. Client Experience: This rating is based on volume of grievances reported by the NAIC and client fulfillment scores reported by J.D.

In this write-up, we'll check out just how average auto insurance rates by age and state can fluctuate. We'll also take an appearance at which of the best auto insurance policy companies supply great price cuts on auto insurance policy by age and compare them side-by-side. Whenever you look for auto insurance coverage, we advise getting quotes from numerous carriers so you can compare insurance coverage and rates.

car affordable auto insurance low cost auto cheap auto insurance

car affordable auto insurance low cost auto cheap auto insurance

insure cheaper car insurance low cost vehicle insurance

insure cheaper car insurance low cost vehicle insurance

Why do average vehicle insurance policy rates by age differ so a lot? 5 percent of the populace in 2017 however represented 8 percent of the total expense of automobile mishap injuries.

The rate information originates from the AAA Foundation for Web Traffic Safety And Security, as well as it accounts for any kind of accident that was reported to the police. The average costs data originates from the Zebra's State of Vehicle Insurance policy report - cheapest auto insurance. The costs are for plans with 50/100/50 responsibility insurance coverage limitations and a $500 insurance deductible for thorough and collision coverage.

7 Easy Facts About Tesla Insurance Explained

According to the National Freeway Traffic Safety And Security Administration, 85-year-old guys are 40 percent more likely to enter a crash than 75-year-old guys - credit. Considering the table above, you can see that there is a straight correlation between the accident price for an age team which age group's typical insurance coverage costs - auto insurance.

Maintain in mind, you could discover far better prices through one more business that does not have a details trainee or senior discount rate. Ordinary Car Insurance Rates And Cheapest Provider In Each State Since auto insurance coverage rates vary so a lot from state to state, the company that provides the cheapest auto insurance in one state may not provide the cheapest coverage in your state.

You'll likewise see the ordinary price of insurance policy because state to assist you contrast. The table also includes rates for Washington, D.C. These price approximates put on 35-year-old motorists with excellent driving documents and credit history. cheap insurance. As you can see, ordinary cars and truck insurance costs vary extensively by state. Idahoans pay the least for automobile insurance coverage, while motorists in Michigan pay out the large bucks for coverage.

https://www.youtube.com/embed/CCBXUuq_gA8

If you reside in downtown Des Moines, your costs will probably be greater than the state standard. On the various other hand, if you reside in upstate New york city, your vehicle insurance plan will likely set you back much less than the state standard. Within states, car insurance coverage costs can differ widely city by city. low cost.

Get This Report about How Much Is Progressive Car Insurance: Cost & Rates

Cancel as well as get your cash back. In the event that you make a decision to terminate your existing insurance policy coverage, you might be able to obtain a reimbursement. vans. The reimbursement procedure and also when you need to obtain it after terminating ought to be reviewed with your insurance policy supplier. Price cuts for buying several plans are a choice to take into consideration.

cheapest auto insurance suvs insurance cheapest car

cheapest auto insurance suvs insurance cheapest car

Consider the discount rate amount when canceling or transforming insurance service providers. Is there a termination fee with Progressive? You may be eligible for a compensation if you terminate your plan before its expiration date with Progressive, which does not normally impose termination fees to its clients. On the various other hand, this isn't constantly true.

Canceling your Dynamic insurance doesn't need to be a bother, and in a lot of situations, the procedure is short as well as straightforward. Nevertheless, by complying with the above-described approaches, you can relieve the change and have a better understanding of what to anticipate in the future. If you want to conserve cash on your auto insurance coverage, you need to obtain all set prior to canceling your current policy.

accident cheaper cheap car trucks

accident cheaper cheap car trucks

Considering Progressive insurance policy testimonials from clients, ordinary cost information, sector standing, and extra, we rate the firm 4. Dynamic insurance coverage testimonials differ.

To see how Dynamic actions up to the best vehicle insurance policy companies, we have actually brushed through Dynamic insurance testimonials as well as investigated the business's monetary stability and also insurance policy coverage choices. money. Progressive Insurance Testimonial: 4.

Progressive car insurance reviews tell us that the cases procedure is concerning average. Progressive Automobile Insurance Coverage Price According to our price quotes, excellent vehicle drivers pay about for full coverage cars and truck insurance coverage.

An Unbiased View of Secrets Of Progressive Insurance Car Accident Claims 2022

Right here's how Progressive's typical rate estimates contrast per state's typical estimates (where information was readily available) (cheapest). These full protection estimates put on 35-year-old chauffeurs with good credit report and tidy driving records. You can see that Progressive is more affordable than average in some states however extra pricey than standard in others.

To assist you save, Progressive offers numerous price cuts, stating that 99 percent of policyholders are eligible for at the very least one price cut - auto insurance. Progressive's discount rates can benefit pupils, great chauffeurs, young chauffeurs, and also much more (cheaper auto insurance). Modern Discount Particulars Get an almost 5% plan price cut for bundling house and also vehicle insurance or an additional of Progressive's insurance coverage items, such as occupants insurance coverage.

credit score auto insurance vans car

credit score auto insurance vans car

Earn a discount rate if you are continually guaranteed without voids or terminations. Get a discount rate if you add a chauffeur who is 18 or more youthful to your plan. Save if you have a student on your policy that keeps a "B" average or much better. Obtain a reduced costs if the full time pupil on your policy lives greater than 100 miles from house and also does not have a vehicle while away (cheaper car).

Past discounts, Progressive has various other methods for consumers to save cash on payments and also deductibles. The safe motorist discount rate program Picture customizes your automobile insurance plan cost to the way you drive, and also an insurance deductible financial savings bank earns you $50 toward your following insurance deductible for every six-month duration without a mishap or ticket.

This insurance coverage choice will spend for substitute products you've included in your vehicle. As an example, if you set up a $1,000 subwoofer and after that obtained in a mishap, this choice would fix or replace it. Numerous rideshare applications just offer extensive protection when you're in fact on a pick-up or drop-off course, not when you're waiting about on the app to get a journey.

According to the J.D. Power 2020 Go here United State Auto Claims Complete Satisfaction Research Study, SM, automobile claims take about 10 days usually to solve. money. Progressive was available in 17th location out of 18 firms in the J.D. Power 2021 U.S. Automobile Insurance Claims Contentment Study, SM, so insurance claims may take longer than average. That stated, we found 29 percent of Modern cases took longer than four weeks to be settled in our customer study.

The smart Trick of Progressive Corporation - Better Business Bureau® Profile That Nobody is Talking About

cheap car cheap car insurance cheaper car low-cost auto insurance

cheap car cheap car insurance cheaper car low-cost auto insurance

https://www.youtube.com/embed/Q-2ZYy4_dlw

You can terminate your plan efficient on that particular same day or timetable a termination in the future - auto insurance. According to the NAIC, Progressive is the tenth-largest residence insurance service provider in the nation - cheap insurance. Modern home insurance provides home protection that can spend for damage from severe weather condition, fire, dropping trees, and also extra.

Getting My Vacation Car Rental Insurance: What You Need To Know To Work